MoolaCon

Here’s an honest and straightforward review of MoolaCon. Explore its features, pricing details, pros, cons, and much more.

MoolaCon Review: A ‘No-Nonsense’ Budget App That Actually Delivers

Budgeting apps usually fall into two categories: too complicated to stick with, or too basic to actually change your spending habits. But MoolaCon is the newest entrant challenging this status quo, designed to do what most finance apps fail at, making daily budgeting feel effortless.

The earlier you start tracking your spending the right way, the faster you stop leaking money without even realizing it. If you’ve been thinking, “I’ll start next month”, you’re probably already behind, and this review is a sign to start now.

In this MoolaCon review, I’ll break down what the tool really offers, how it works in real life, and whether it’s genuinely worth using, or just another trendy money tracker you’ll uninstall in a week.

Pros and Cons of MoolaCon

Pros

- Uses a unique 5-tier system to give an immediate ‘Spending Readiness Condition’ rather than just static numbers

- Features a countdown timer that tells you exactly when your budget health will recover (days/hours/minutes) if you are trending into a deficit

- Deliberately avoids cluttered charts, making it less overwhelming for users who find traditional dashboards complex

- Designed for minute-by-minute updates to influence daily spending decisions as they happen, rather than reviewing past behavior at the end of the month

- Because it does not sync with bank accounts, users maintain tighter control over their financial data privacy

Cons

- The tool focuses exclusively on expense tracking. It does not track income, investments, or overall net worth

A Closer Look at MoolaCon’s Features

MoolaCon is a personal budgeting application designed to replace complex financial dashboards with immediate, actionable guidance for daily spending decisions. Here are the features that make it stand out among other budgeting apps-

1. Real-Time Spending Readiness

2. Predictive Spend Timer

3. No-Sync Privacy Model

MoolaCon deliberately operates without syncing to bank accounts. It ensures complete data privacy and encourages active engagement by requiring you to manually interact with your spending entries rather than relying on automated feeds. This will make you more responsible towards your expenses.

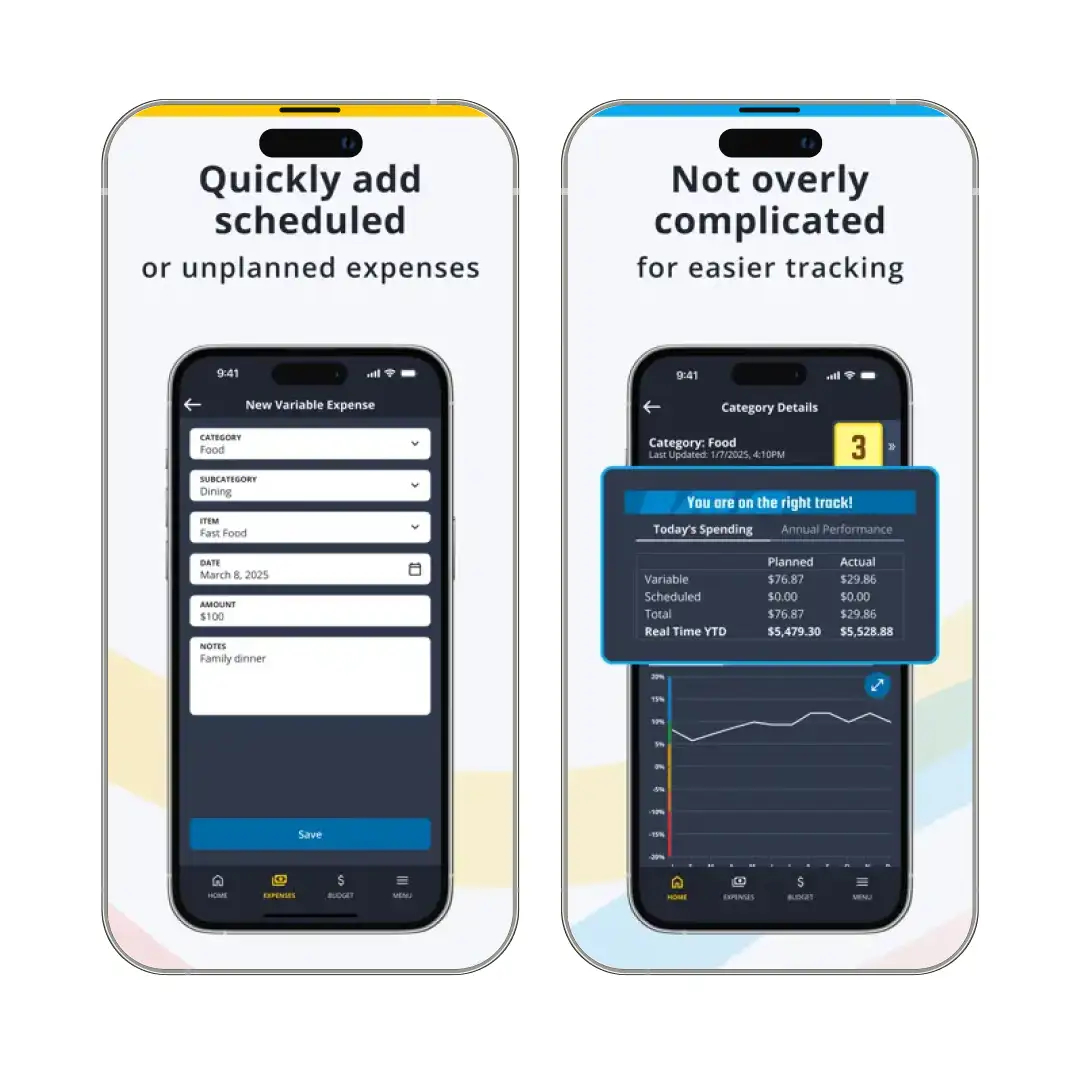

4. Clutter-Free Interface

5. Daily Decision Support

Unlike tools that review past behavior, MoolaCon is built to influence decisions in the moment. Its Real-Time Insights connect individual transactions to long-term goals instantly, helping you avoid debt before it happens.

Bonus Read: Best Free Expense Tracker Apps

MoolaCon’s Pricing and Subscription Plans

MoolaCon operates on a subscription-based model that begins with a 30-day free trial. Users can choose between a monthly or yearly payment plan to maintain full access to the app's features.

| Plan Type | Cost of the Plan |

|---|---|

| Monthly Plan | $4.99 / month |

| Yearly Plan | $49.99 / year |

*New users receive full access to all features for the first 30 days.

*If you choose not to subscribe after the trial ends, you will retain "View Only" access. You can still see your budget history, but you will be unable to make changes, add new expenses, or adjust your budget unless you upgrade to a paid plan.

For us, Product Reviews mean diving headfirst into the functionality of each digital product, whether it’s an app, software, or website. Our process centers around hands-on testing of each tool we pick. From scrutinizing features to testing vulnerabilities of security standards, the goal remains to help you find products that don’t just work but truly elevate your experience. In a nutshell, if we’re recommending a product, it’s because we believe it’ll genuinely make your digital life easier.

- Products Reviewed - 4,000+

- No. Of Experts - 20+

- Categories - 65+

Customer Reviews

How was your experience with the product?

MobileAppDaily’s Ratings for MoolaCon

FEATURE

Focuses on behavioral change with a unique 5-tier ‘Spending Readiness’ system and a predictive ‘Spend Timer’ for recovery tracking

PRICING

Offers a competitive pricing option with a generous 30-day free trial and post-trial ‘View Only’ access

PERFORMANCE

Delivers instant, bug-free feedback by eliminating bank syncing and relying on direct user input

UI/UX

A strictly clutter-free interface that rejects complex charts for a simplified, glanceable dashboard

How Does MoolaCon Work?

MoolaCon operates on a health check model rather than a traditional accounting ledger. Instead of just showing you raw numbers, it interprets your data into actionable statuses and clear categories to help you make better daily decisions. Here’s how this app works-

1. The Readiness Level System

The core functionality of this tool is the Spending Readiness Level, a simple score ranging from 1 to 5. This score gives you immediate feedback on your financial health without requiring you to analyze complex charts.

- Level 5 (Surplus): Indicates you are doing excellently, with a budget surplus greater than 10%.

- Level 3 (On Track): Indicates you are stable and staying within 5% of your planned budget.

- Level 1 (Deficit): Indicates a critical status where you have a budget deficit greater than 10%.

2. Strategic Categorization

To help you identify exactly where your money is going, MoolaCon organizes expenses into broad categories with specific sub-categories. You can use defaults or create your own.

- Essentials Category: Includes Home (Rent/Mortgage, Utilities), Transportation (Fuel, Auto Insurance), and Food (Groceries, Dining Out).

- Lifestyle Category: Includes Personal (Subscriptions, Pets), Vacation (Airfare, Hotels), and Giving (Donations).

- Performance View: The app highlights specific categories that ‘need help’ versus those that are performing well, allowing you to adjust habits in specific areas.

3. Expense Management

MoolaCon allows you to distinguish between two types of spending to refine your budget accuracy:

- Scheduled Expenses: Fixed, recurring costs (like rent or insurance).

- Variable Expenses: Fluctuating daily costs (like dining out or fuel).

MobileAppDaily’s Final Verdict for MoolaCon

Now that my budget was finally on track, I decided to share this gem of a tool with my teammates as well and collected their MoolaCon reviews. The consensus is clear: this tool successfully bridges the gap between rigid accounting tools and over-simplified expense trackers.

By replacing complex charts with a 5-tier system and a predictive timer, it shifts the focus from passively recording history to actively influencing daily decisions. For users tired of leaking money, this behavioral approach offers a refreshing and effective alternative.

The no-sync model requires manual input, forcing a level of accountability and engagement that automated feeds often mask, all while keeping your financial data strictly private. The interface is deliberately clutter-free, stripping away the noise of pie charts to give you immediate, actionable answers. All this, combined with a consumer-friendly pricing model, MoolaCon proves it is designed with the user's best interest in mind.

If you are looking for a tool that prioritizes financial discipline and real-time clarity over automated dashboards, MoolaCon is the perfect choice. It delivers exactly what it promises: a no-nonsense companion for keeping your spending on track, minute by minute.

MoolaCon

Frequently Asked Questions

-

What is MoolaCon?

MoolaCon is a personal budgeting application designed to improve financial behavior through real-time feedback rather than complex analytics. It uses a unique 5-tier ‘Readiness Level’ system to tell you immediately if your budget is healthy.

-

How to use MoolaCon?

-

Does MoolaCon sync with my bank account?

-

How much does MoolaCon cost?

-

What is the predictive Spend Timer in MoolaCon?

Latest Products

Delve into our comprehensive yet easy-to-consume guides, which provide insights that help scale business faster and prevent unseen pitfalls.

Related Products

Cut through the clutter and explore related digital products that deliver on performance.