- What is FinTech Blockchain?

- Exploring the Power of Blockchain in Fintech

- Conquering Fintech Challenges with Blockchain

- How Blockchain is Leading Innovation in the Fintech Industry

- What are the Advantages of Blockchain in Finance?

-

Looking at the Blockchain Applications in Finance

- Financial Services

- Processing Payments and Transferring Funds

- Medical Care

- The Government

- Retail and CPG

- Tourism and Hospitality

- Monitoring Supply Chains

- Programs for Retail Loyalty Rewards

- Electronic Identification or Digital IDs

- Sharing of Data

- Protection of Copyright and Royalties

- Electronic Voting

- Types of Financial Companies Benefitting From Blockchain?

- Why Trust MobileAppDaily?

- Conclusion: Why Blockchain is the Future

In recent years, the fusion of blockchain technology and the Fintech sector has sparked a revolution in how financial services are delivered. With the unique qualities of the decentralized and secure nature of blockchain, now Fintech companies are set to redefine traditional banking and investment practices. Today, this technology stands strong in enhancing transparency, reducing fraud, and streamlining transactions. Ultimately, it is making financial processes more efficient and accessible.

As we know, the consumers of today are increasingly relying on faster and more secure financial solutions. This is where blockchain emerges as a game-changing option by letting users get real-time settlements and reducing operational costs. Nonetheless, it also holds the potential to democratize the doors to effective finance and unbanked populations which enables access to essential services. From smart contracts to tokenized assets, the applications of blockchain in Fintech industry are vast and varied.

Join us as we explore how this powerful technology is reshaping the financial landscape and what it means for the future of money management and investment strategies.

What is FinTech Blockchain?

Fintech blockchain, a popular term, simply refers to the application of blockchain technology with finance services or Fintech. This is done essentially using a decentralized, distributed ledger system to process and record financial transactions securely and transparently, often eliminating the need for intermediaries like banks in traditional financial systems; it allows for faster, more efficient, and secure financial operations across various areas like payments, lending, investment management, and more.

Key Utilities of Blockchain in Fintech Industry

Decentralization:

The transactions are easily recorded across the computer networks rather than relying on central authority and enhancing security.

Smart contracts:

Self-executing contracts embedded within the blockchain that automate certain financial processes based on predefined conditions.

Immutability:

When you enter or record the transition on the blockchain, you cannot alter or delete it.

Exploring the Power of Blockchain in Fintech

A decentralized peer-to-peer (P2P) ledger known as blockchain keeps track of transactions on an open, tamper-proof computer network.

The technology has been in use for more than ten years, and at least six of those years have been spent in the finance industry. Decentralized finance (DeFi), a new model for financial operations, is the result of blockchain implementation for Fintech.

Technologies that facilitate distributed financial transactions on blockchain networks are referred to as DeFi. DeFi can inarguably be a great tool when it comes to improving the accessibility, transparency, and security of financial services by blending Fintech and blockchain. Additionally, it facilitates asset exchanges between individuals and businesses without the need for middlemen.

- With a 2022 valuation of $10.02 billion, the worldwide blockchain in the Fintech industry is all set to surge at a CAGR or the compound annual growth rate of 87.7% until 2030.

- In 2022, the DeFi market was valued at $13.61 billion, and it is anticipated to grow at a 46% compound annual growth rate until that year.

- Additionally, in 2021, venture investors nearly tripled their investment in Fintech businesses, investing over $133 billion.

It is evident that financial institutions favor distributed ledger technologies. Let's examine how it can fill the gaps in conventional financial services to determine why.

Conquering Fintech Challenges with Blockchain

Undeniably, the conventional financial systems have flaws. Slow transaction times, exorbitant fees, and a lack of transparency are common problems for blockchain in enterprises. Many of these issues are resolved when blockchain is included in Fintech.

Elevated Operational Expenses

Undeniably, blockchain holds the potential to lower transaction costs in the Fintech sector. Even an easy credit card transaction in a typical system involves multiple parties: the credit card network, the bank, and the retailer. Every organization charges for its services.

With the involvement of a larger network of financial institutions, this issue is made worse for cross-border payments and foreign exchanges. For a single transfer, a client can be assessed receiving, correspondent, middleman, and conversion costs.

Blockchain removes middlemen from financial operations by using decentralized protocols and peer-to-peer transactions. For blockchain in Fintech industry and their customers, this speeds up processing and lowers transaction costs.

Restricted Availability of Services

In some cases or situations, there can be restriction to the use or access to Fintech services. For instance, a user's access to an app while traveling may be restricted by technological limitations or legislative restrictions. Additionally, a business can not have any remote support employees or physical branches.

Fintech businesses may function without the limitations of conventional banking systems thanks to blockchain. Clients can now operate from anywhere at any time with the help of decentralized apps, cryptocurrencies, and smart contracts. To make it simple, now you can access financial services globally anytime you want.

Risks to Security

Ensuring data security across platforms while maintaining consumer privacy is a significant concern in the financial industry. Both external (such as fraud and cyberattacks) and internal (such as weaknesses linked to inadequate access restrictions, staff members' ignorance of cybersecurity, and the quick adoption of cloud computing without adequate security measures) security concerns are possible.

When compared to other industries, the financial industry is really still the most susceptible to cybercrime. Securing digital assets and sensitive data is a major worry for Fintech companies, as seen by the 1,829 incidents that were recorded in 2022 alone.

Three essential features of blockchain lower fraud and cybersecurity risks:

- Decentralization: Since blockchain technology is decentralized, there is no single point of failure, making it more resilient to security breaches. A network of nodes encrypts and verifies every transaction.

- Encryption: Blockchain networks transfer data between users using hashing and Cryptography methods. After that, the encrypted transactions are added between the network's other blocks.

- Unchangeability: A blockchain ledger's nodes cooperate to verify transactions. The data is more resistant to tampering because only the consent of other nodes can alter a single operation.

Fintech businesses can now work to strengthen their security measures and also reduce the risk of cyberattacks with the implementation of blockchain use cases.

Inability to Trace

Fintech companies have traceability issues due to traditional banking systems. Even straightforward processes require several middlemen, as we've already mentioned, making tracking and verification more difficult. Furthermore, the high degree of centralization in traditional systems leads to issues with transparency and increased tampering threats.

Unmatched traceability is made possible by blockchain technology's distributed, decentralized, and publicly accessible ledger. Every transaction is recorded and validated by intricate algorithms and consensus mechanisms. Because of this, users can examine any network transaction, and auditors can quickly confirm blockchain in Fintech operations.

Slow Procedures

Earlier, the conventional Fintech systems had long settlement timeframes that might vary from a few hours to many days. This is because numerous middlemen and clearinghouses are involved, and human processing is required.

Blockchain is made to be quick. It allows businesses to streamline authorization and verification processes, which shortens settlement times and minimizes the time required to process transactions and validate payments.

Customers will benefit from faster and less expensive bank transactions. Banks are also able to process payments virtually instantaneously and cut down on costly infrastructure and departmental overhead.

Blockchain in business is perfect for addressing the primary issues facing the financial industry since it allows for the quick and safe processing of financial transactions.

How Blockchain is Leading Innovation in the Fintech Industry

In this fast-paced world we live in, everyone is better informed and aware of emerging technologies launching. Blockchain is transforming the Fintech sector by simply making it transparent, safe, and affordable for every stakeholder. This technology is no longer merely new; it is well-established and may be utilized to improve numerous sectors and industries, including healthcare, education, and others.

Additionally, blockchain has changed the banking industry, which has made it possible to do online tasks from home without having to leave the house or stand in line for hours at an ATM.

Blockchain is an innovative solution that reduces stakeholders' expenses and helps to minimize fraud threats. New payment mechanisms offered by blockchain, such as cryptocurrencies or virtual currency like Bitcoins, are simplifying and enhancing the security of transactions.

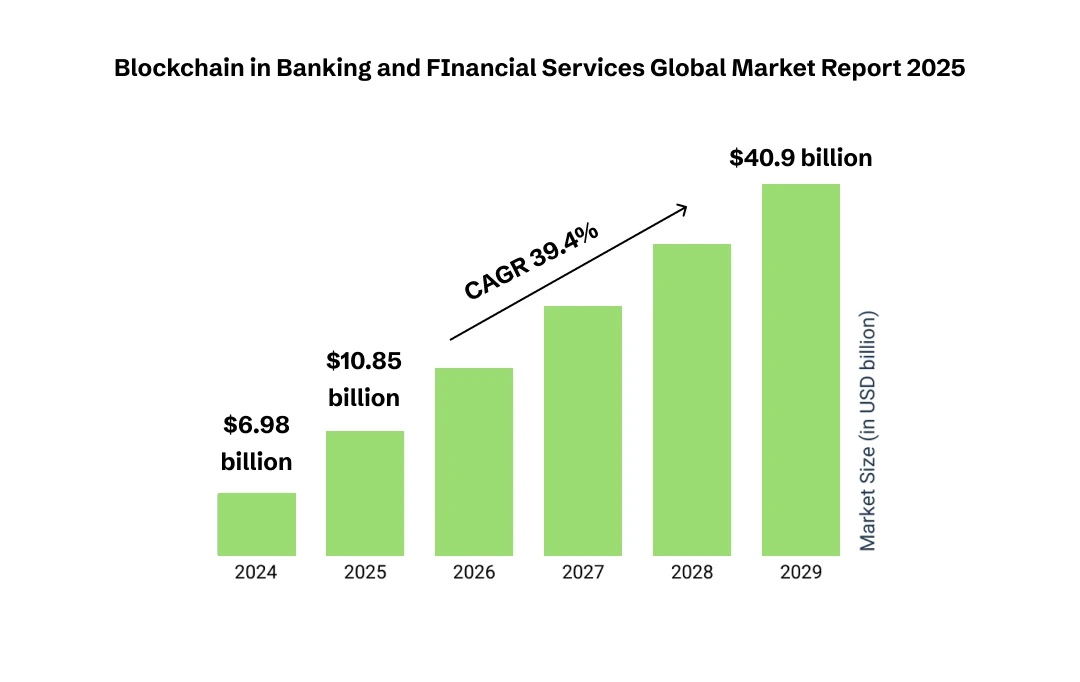

The market for blockchain in banking and financial services has expanded rapidly in the last several years. With a compound annual growth rate (CAGR) of 55.3%, it will increase from $6.98 billion in 2024 to $10.85 billion in 2026. Strong economic growth in emerging nations, the growing need for quick and real-time fund transfers, the rise in digital banking services, and more government efforts are all responsible for the expansion over the historic period.

Five Ways Blockchain Technology Is Transforming the FinTech Sector

1. Smart Contracts Based on Blockchain

A smart contract is a digital contract that automatically carries out its conditions. These smart contracts, which are more secure than conventional paper agreements because they do not require the physical signatures of all parties, are created and managed with the use of blockchain in Fintech.

2. Save Time and Money

With Blockchain, transactions can be completed without the involvement of a middleman or third party. In addition to speeding up the process, this lowers transaction expenses. The parties can communicate directly with one another to complete financial transactions quickly, which cuts down on the time delays that come with using traditional banking techniques.

3. Reducing the Risk of Fraud

Cryptography is used by blockchain technology to protect all financial and non-financial data, making it more difficult for hackers to access these platforms. Furthermore, the decentralized platform provided by Blockchain makes it extremely difficult for hackers to change information covertly.

4. Simpler International Transactions

By eliminating obstacles like various currencies, value transfer delays, foreign exchange costs, etc., blockchain helps to make international payments simpler and quicker.

5. Greater Accessibility & Transparency

Blockchain technology's distributed ledger system, which stores a single version of records, makes auditing generally more effective and economical. Additionally, blockchain technologies are being used by banks more and more to help people worldwide.

What are the Advantages of Blockchain in Finance?

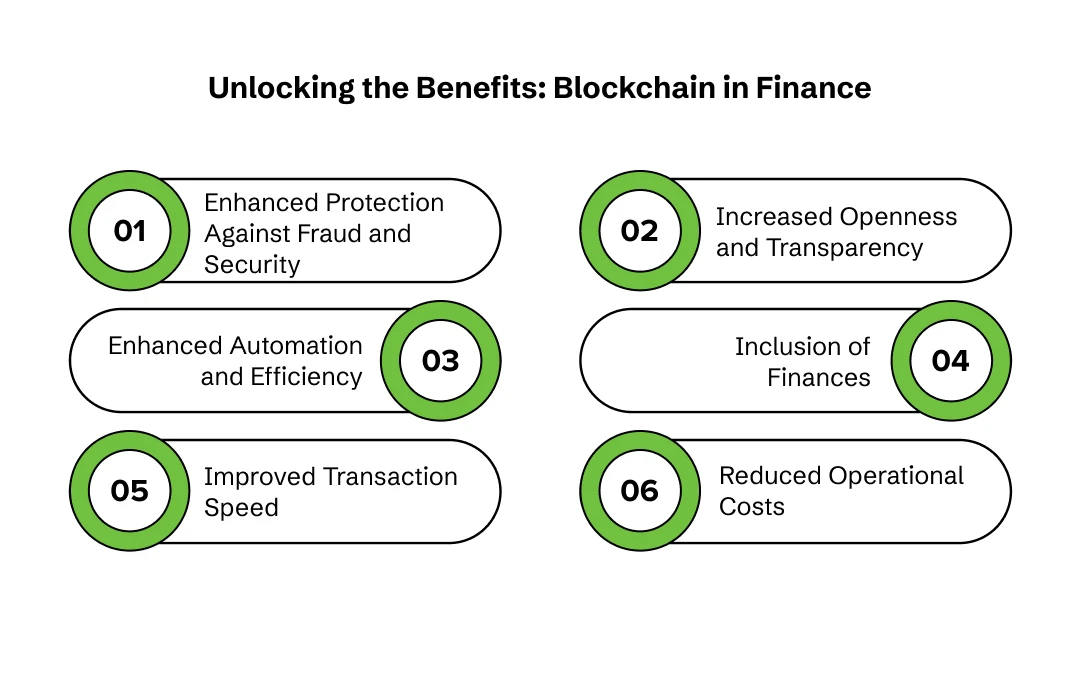

As you can see, a large number of financial institutions, including banks, use blockchain technology to enhance their operations. Here are a few benefits of blockchain in finance they anticipate from doing so.

1. Enhanced Protection Against Fraud and Security

The decentralized and unchangeable nature of blockchain technology makes it nearly difficult to alter its records. Criminal and terrorist groups may find it more difficult to launder money in the future due to stricter regulations and improved security measures in the blockchain sector. Consequently, financial institutions can encourage transparency within their businesses by utilizing private blockchain networks.

2. Increased Openness and Transparency

The immutable record found in blockchain technology may assist in strengthening banking sector transparency. A better customer experience is produced by increased trust in banking systems due to improved security. More people are likely to conduct business with financial institutions that hold themselves responsible for their actions.

According to the Federal Deposit Insurance Corporation (FDIC), “Transparency is essential because "it helps maintain trust in the safety and soundness of the banking system." It lowers conflict, promotes more stable economic growth, and boosts public engagement.

Many governments are implementing stringent restrictions to boost consumer confidence and lower fraud as the cryptocurrency business continues to expand. Transparency is, therefore, essential to the functioning of cryptocurrency exchanges and other companies involved in the industry. Thankfully, blockchain gives these companies the ability to automatically log financial transactions in order to stay in compliance.

3. Enhanced Automation and Efficiency

Smart contracts are typically used by blockchain networks. These are applications that are kept on blockchain networks and are made to do particular tasks. When a condition is satisfied, smart contracts automatically execute sophisticated algorithms.

Blockchain apps don't require any paperwork because they are fully digital and automated. In addition to lowering the possibility of expensive mistakes, this lowers transaction and logistical expenses.

4. Inclusion of Finances

Blockchain technology promotes financial inclusion, especially by giving underbanked and unbanked people access to financial services. Access to digital currency for all types of people is crucial because blockchain is the foundation of cryptocurrencies. Anyone can access cryptocurrencies and blockchain-backed digital assets, including people who would not be eligible for a traditional bank account.

Looking at the Blockchain Applications in Finance

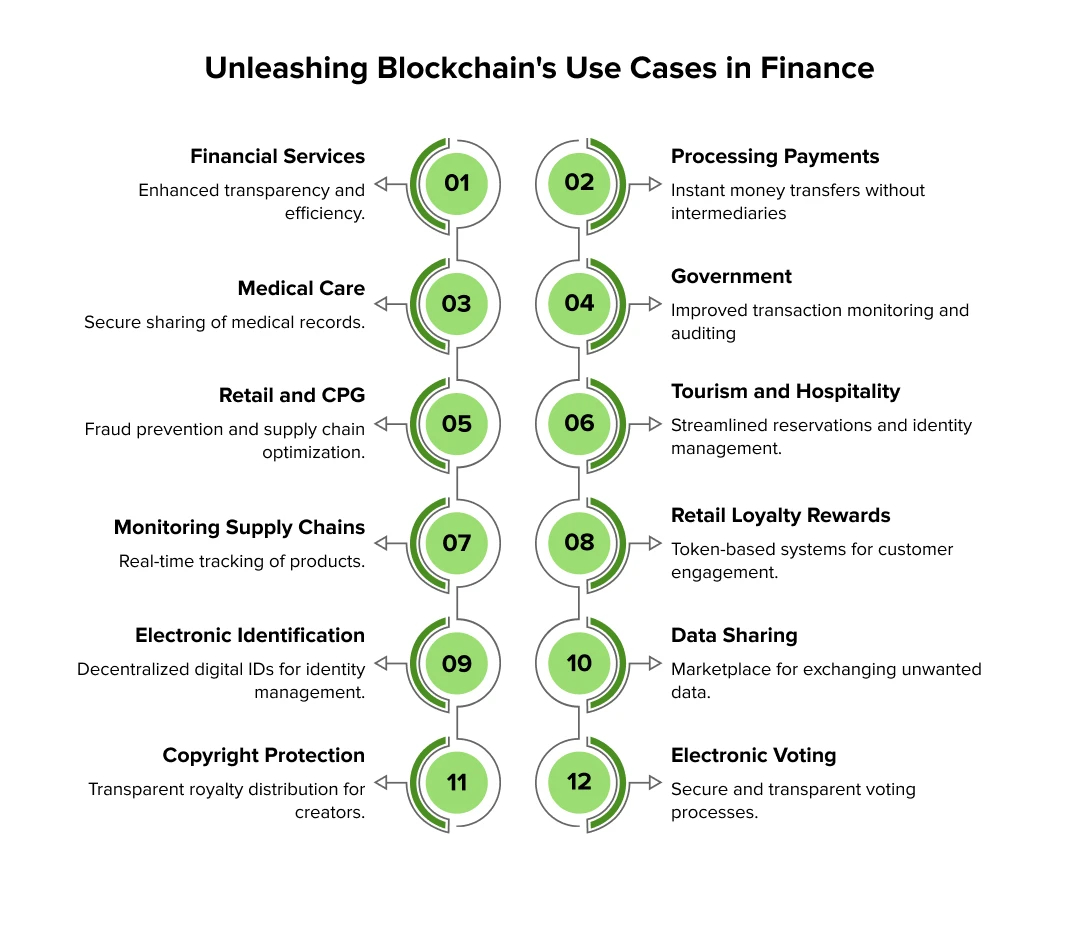

Numerous industries, including financial services, healthcare, government, travel and hospitality, retail, and CPG, can use blockchain technology. Blockchain technology will facilitate trade and make life easier. Blockchain will simplify navigation in our digitalized environment and transform a wide range of industries. This technology will prove to be very significant in the future since it is a very secure system that is impervious to corruption. The following discusses a few of the blockchain applications in finance:

Financial Services

This technology has already been used in the financial services industry in a variety of creative ways. By offering an automated trade lifecycle where all participants have access to the same transaction data, blockchain technology makes the entire asset management and payment process more transparent. This guarantees transparency and efficient handling of transactional data while doing away with the need for brokers or other middlemen.

Processing Payments and Transferring Funds

Using blockchain to speed up money transfers between parties is arguably its most obvious application. As mentioned, the majority of transactions executed via a blockchain are frequently completed in a matter of seconds because banks are not involved, and transaction validation is done continuously every day of the week.

Medical Care

By improving the privacy, security, and interoperability of data, blockchain in healthcare can be extremely beneficial to the industry. It has the ability to address a number of these issues in the industry and facilitate the safe exchange of medical records across various organizations and other participants.

It eliminates third-party meddling and saves money on overhead. Blockchains are frequently used to store medical records in dispersed databases by encrypting them and using digital signatures to ensure their legitimacy and privacy.

The Government

Blockchain technology has the potential to revolutionize government services and operations. It has the potential to significantly improve the information transactional difficulties facing the government sector, which presently operates in silos. Better knowledge management across several departments is made possible by appropriately connecting and exchanging knowledge with blockchain in manufacturing and other industries. It increases transparency and offers a far more effective method of transaction monitoring and auditing.

Retail and CPG

The retail industry presents a huge opportunity for the application of blockchain technology. This covers a wide range of tasks, such as verifying the legitimacy of expensive goods, stopping fraudulent transactions, tracking down lost goods, providing virtual warranties, maintaining loyalty points, and optimizing supply chain processes.

Tourism and Hospitality

Blockchain technology has the potential to revolutionize the travel and hospitality sector. It is frequently used for financial transactions, reservations, travel insurance, loyalty, and rewards management, as well as the storage of critical papers like passports, voter IDs, and other identification cards.

Monitoring Supply Chains

Additionally, blockchain is especially useful for supply chain monitoring. Businesses should be able to identify supply chain inefficiencies quickly and locate products in real time by eliminating paper-based traces. Additionally, blockchain would enable companies—and perhaps even customers—to examine how well things functioned from a quality-control standpoint during their journey from the manufacturer to the retailer.

Programs for Retail Loyalty Rewards

Blockchain will eventually become the standard for loyalty rewards, revolutionizing the shopping experience. Customers may be encouraged to return to a specific store or chain to attempt their shopping if a token-based system that rewards them is developed and stored on a blockchain. Additionally, it might eliminate the fraud and waste that are frequently associated with loyalty incentive schemes that rely on paper and cards.

Electronic Identification or Digital IDs

Approximately 1 billion people worldwide struggle with their identity. Microsoft wants to change that (NASDAQ: MSFT). Its Authenticator software, which is presently used by many, generates digital IDs that may help users control their digital identities. People in underdeveloped areas will be able to, for instance, launch their own businesses or demand access to banking services. Microsoft's efforts to create a decentralized digital ID are still in their infancy.

Sharing of Data

Cryptocurrency IOTA showed that blockchain might be used in a marketplace to exchange or sell unwanted data by launching a test version of its Data Marketplace. Since the majority of company data is wasted, blockchain might serve as a middleman to store and transfer this data, improving a variety of industries. Even while IOTA is still in its infancy, it has already received input from 35 well-known brands.

Protection of Copyright and Royalties

Ownership and copyright regulations and compliances for music and other information have become murky in a world where internet access is becoming more and more common. Blockchain would significantly strengthen copyright regulations for digital material downloads, guaranteeing that the originator or artist of the content being bought receives their fair share. Musicians and content producers will also be able to access real-time and transparent royalty distribution data thanks to blockchain technology.

Electronic Voting

With blockchain technology, voter fraud can be clarified. Blockchain allows for digital voting, but it is transparent enough that regulators might easily observe any changes made to the network. It creates a really unique vote by fusing the immutability (i.e., unchanging nature) of blockchain technology with the ease of digital voting.

As previously said, there are several blockchain financial use cases in the modern world. Blockchain guarantees the safety and security of customers and the data or files associated with them. Blockchain is poised to become the next big thing in the upcoming decades, helping a wide range of industries, including finance, healthcare, and the government sector.

Types of Financial Companies Benefitting From Blockchain?

The blockchain in finance industry is reshaping traditional models, providing robust solutions for efficiency, transparency, and security. From banking to insurance, various financial sectors are leveraging the benefits of blockchain in finance to stay competitive in the digital era. So here are the challenges of blockchain in Fintech:

1. Banks and Payment Institutions

Banks are utilizing blockchain technology in finance to streamline cross-border payments, eliminate intermediaries, and reduce transaction costs. With blockchain's decentralized ledger, real-time settlement of payments ensures faster and more transparent processing.

2. Investment Firms

Investment firms benefit significantly from blockchain Fintech solutions, particularly in asset tokenization. This innovation allows fractional ownership, making investments more accessible to a broader range of clients. Additionally, smart contracts simplify complex trade settlements, reducing operational overheads.

3. Insurance Providers

The insurance sector is overcoming key inefficiencies with blockchain in finance industry applications. Blockchain enhances claims processing by automating verification processes and reducing fraud. Shared ledgers ensure better data management and improve trust among all stakeholders.

4. Lending Platforms

Lending platforms are tackling the challenges of blockchain in Fintech by leveraging decentralized finance (DeFi). Blockchain ensures secure, peer-to-peer lending while reducing credit risk through transparent records and smart contract enforcement.

5. Regulatory Agencies and Compliance Firms

Regulatory agencies benefit from blockchain technology in finance by gaining real-time access to audit trails. This transparency helps detect irregularities, ensuring adherence to compliance standards without unnecessary manual intervention.

Note: Unlock the Potential of Blockchain in Finance

Despite the challenges of blockchain in Fintech, its adoption in the finance sector is accelerating, driving innovation and unlocking new opportunities. If you're looking for trusted resources and the best solutions, MobileAppDaily offers curated directories to connect with top-tier blockchain service providers. Explore the possibilities of blockchain Fintech solutions today.

Why Trust MobileAppDaily?

MobileAppDaily highlights the disruptive potential of blockchain technology and enables businesses to navigate its complex finance market. We offer thorough materials and professional advice to help you navigate the challenges of incorporating blockchain technology into financial services.

From comprehending the foundations of blockchain to investigating its practical uses in Fintech, our in-depth articles cover everything. You may improve your business plans by making well-informed decisions by keeping up with the most recent developments and trends. Furthermore, MobileAppDaily assists you in locating and getting in touch with top blockchain development firms that meet your particular requirements.

Conclusion: Why Blockchain is the Future

Blockchain technology in finance is still in its early stages, but it has the potential to fundamentally alter how we handle money. Though challenges remain, Fintech companies are already benefiting from blockchain's increased security and transparency.

Scalability is one of the primary factors. One of the main obstacles to blockchain technology's adoption in the financial sector is its incapacity to handle enormous volumes of data. Concerns about regulations and issues with interoperability (between blockchain networks and existing financial systems) are also impeding development. Because of these and other challenges, it is too soon to say that blockchain is transforming the financial industry. Even though the technology has a lot of potential for the financial sector, more work needs to be done before it can be used widely. As technology develops and finds solutions for problems like scalability and regulation, we'll likely see more incredible application cases.

Well, is the future of blockchain in Fintech secure and ready? It's too soon to declare that blockchain is revolutionizing the Fintech sector due to these and other obstacles. Although the technology offers promise for the financial industry, it must develop before it can be widely used. There will probably be more astounding application cases as technology advances and solves issues like scalability and regulation.

Frequently Asked Questions

-

What is the difference between Fintech and blockchain?

-

How does blockchain technology affect finance and accounting?

-

How does blockchain enhance Fintech security?

-

Is it possible for blockchain to simplify international payments?

-

In what ways can blockchain enable effective and transparent lending?

-

How can blockchain help Fintech companies comply with regulations?

-

Is Bitcoin a Fintech?

-

What Are the Four Types of Blockchain?

-

What role does blockchain play in Fintech compliance?

-

Are there specific regulations for blockchain technology in Fintech?